Jacqueline Chan works as an Investment Analyst in Public Equities. She holds a Bachelor of Arts with distinction, double major in Economics and Asian Studies and minor in Real Estate from Cornell University.

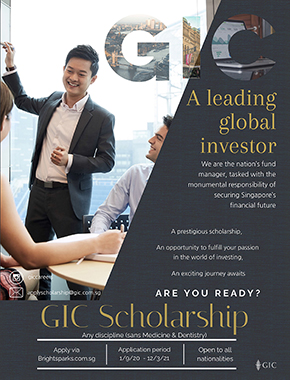

GIC's investments extend beyond asset classes. It takes great pride in investing in its people. One of the ways it exemplifies this is through the GIC Scholarship, which has allowed the company to groom and nurture passionate individuals to fulfil their full potential and contribute to shaping the nation's future.

GIC certainly recruited well in Jacqueline Chan, a GIC Scholar who is now an Assistant Vice President with the Public Equities team. We catch up with her on what working at GIC is like.

Financing a Choice

As a child, Jacqueline's family had an independent, nomadic lifestyle, often moving from place to place. So when 15-year-old Jacqueline wanted to stay in Singapore rather than move with them to their next destination, they gave her just $6,000 to last till university.

This essentially became a crash course in finance management for a 15-year-old, and she applied to bursaries and sponsorships, took up part-time jobs, and religiously did her accounts to make the dollars and cents last.

The GIC Scholarship was one more avenue to education without having to spend.

“To be a good investor, you have to look at what's available out there, right?” laughed Jacqueline. “So, in the same vein, I just wanted to know what my options were and make the best decision out of it. And GIC seemed like a good long-term career option.” Tutors and friends alike supported her decision, and it has proven to be a challenging and fulfilling journey for Jacqueline.

“For me, I guess it really came down to where I saw of myself working, the advice I was given and the advice I would give as well. Ultimately, it's a career choice, not just a scholarship choice.”

And the deciding factor? The international reach of the company. “GIC offers great international exposure,” Jacqueline shared.

“You talk to corporates from any corner of the world and interact with many people who run their own businesses. Internally, you will also get to converse with colleagues from different offices and see things from their perspectives.”

Preparing For The Future

Did her excellent grades from Cornell University help her in her work? Jacqueline smiled as she admitted that nothing was directly applicable.

But that, according to her, is not the point of a university education anyway. The life lessons she learnt at Cornell – about how to apply the basics to solving problems, and never give up – stand her in good stead as she navigates the complex financial world.

“The biggest takeaway for me was that it's impossible to learn everything that is out there and at some point in time, the answer is not going to be in some books,” she reflected.

Jacqueline Chan

“Whether you're a lawyer, a doctor, or an investor, it's the same. You need to know the basics well and be agile enough to apply these basics to your work.”

This is in-line with GIC's philosophy, which strongly encourages its scholars to broaden their horizons through overseas student exchange programmes, summer programmes, foreign language studies and internships with other organisations. It is clear that GIC believes it is the right kind of independent thinking – and not the right formula from a book – that makes one stand out.

Most definitely, Jacqueline is standing out. As a public equities analyst, her foremost responsibility is to manage the performance of a portfolio of stocks. Her job includes speaking to different companies and analysts, reading financial and research reports, and creating quantitative models to better understand the value of a company. This responsibility is supported by years of fundamental work: analysing and monitoring these individual companies and the markets they operate in, to allow her to make the right investment decision at the right time.

Farmer Girl

In contrast to her polished, city-slicker image, Jacqueline worked on her parents' farm in the United States – where she had to clean up after cows and chickens.

Knowing Yourself

To young talents who may be considering GIC and working in the investment industry: “Apply to as many scholarships as possible.”

“Because it is through the process of applying and through the questions that the interviewers asked you, or through the tasks that the interviewers get you to do, that you get to learn more about the company as well.”

Like the independent-minded person she has always been, Jacqueline reminded us about the value of individual choice in selecting further education. “You should ask yourself what you're good at and whether you think you can fit there. This way, it's more intuitive. Talk to more people to figure out whether this is something you foresee yourself doing, and don't just think of it as a scholarship.”

While Jacqueline enjoys the intellectual challenge, the international exposure, and the personal growth she experienced as an investment professional in GIC, she pointed out that every individual is motivated differently.

She concluded: “why should I join GIC? – that's not a question you should ask me, that's a question you should ask yourself.”