Left: Deanna Kwa Hui Ling assesses industrial properties in her role as a Valuer. She is an IRAS Mid-Term Undergraduate Scholar and holds a Bachelor of Science in Real Estate at the National University of Singapore.

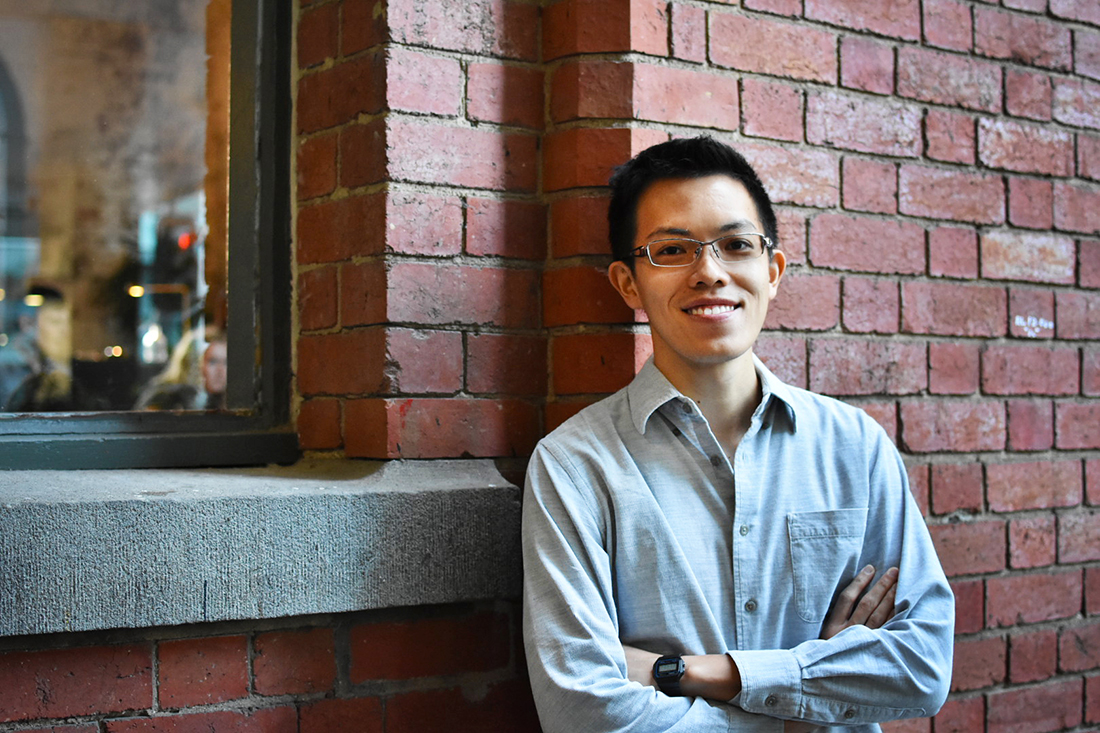

Right: Jordan Li Zhiwen, an IRAS Merit Undergraduate Scholar, reviews tax policies as a Senior Associate (Tax Strategy) and is currently on secondment at the Ministry of Finance. He graduated Summa Cum Laude from Singapore Management University with a double degree in Accountancy and Business Management.

T he Inland Revenue Authority of Singapore (IRAS) hardly needs much introduction. If you have worked in some capacity or owned any asset, chances are, you would have received a notification or two from IRAS.

The IRAS is the main tax administrator to the Singapore Government and it collects taxes that account for about 70% of the Government’s Operating Revenue which supports economic and social programmes.

However, beyond the work that IRAS does for Singapore, the agency also focuses on people development. Under its “Everyone Matters” initiative, IRAS believes that every staff plays an important role in achieving IRAS’ vision to partner the community in nation building and inclusive growth.

Contributing to IRAS’ vision and objectives are its scholars, Deanna Kwa Hui Ling and Jordan Li Zhiwen.

Deanna assesses properties for tax purposes in her current role as a Valuer, while Jordan develops tax policies as a Senior Associate, on secondment at the Ministry of Finance.

They shared with BrightSparks on the engaging work that they do at IRAS, as well as their goals and aspirations.

Deanna Kwa

A High-Valued Career

While many of her peers were looking into memes, movies or the latest food fads in and around town, Deanna was having serious conversations about real estate with her family members when she was 16 years old. At that juncture, Singapore had to implement significant cooling measures to quell the demand of the property market. The subject matter piqued her interest. So much so, she decided to study Real Estate and make a career out of it.

“I remember very vividly that there was a buzz about the new policy, and I would often hear the topics of ABSD (Additional Buyer’s Stamp Duty) and SSD (Seller’s Stamp Duty) at family or social gatherings,” enthused Deanna.

“I wanted to learn more about the policy, so I started reading up on real estate in Singapore and would visit show flats occasionally to talk to the property agents to find out more. This led me to pursue a Diploma in Real Estate at Ngee Ann Polytechnic and later, a Degree in Real Estate at NUS.”

Deanna was not only interested in real estate, she also excelled at it academically. She was already on a scholarship from the NUS Department of Real Estate before she applied, and eventually took on the IRAS Mid-Term Undergraduate Scholarship in her second year.

She recalled: “I took a module during my second year of university called ‘Property Tax and Statutory Valuation’. It was conducted by an amazing adjunct associate professor, Ms. Ang Sock Tiang, who used to be Assistant Commissioner at IRAS’ Property Tax Division. Her passion for imparting her valuation skills and property tax knowledge inspired me to try out for an IRAS Scholarship. In fact, that was the only scholarship I applied for!”

It was a direct transition from the classroom to the proverbial boardroom.

On her current role, the 23-year-old said: “I am a Valuer at the Property Tax Division, Industrial Branch – Specialised Properties team, and I conduct property assessments for specialised industrial properties such as petrochemical, pharmaceutical, incineration plants, and so on.”

She also conducts assessment works for high-rise and landed industrial properties. The exposure to varying work even within the realm of valuation allowed her to hone her professional skills and expertise.

Beyond the ground work, Deanna shared that she has been presented with many opportunities, as with others who are keen to make a difference. One of the learning opportunities was the chance to work on policy reviews with other experienced colleagues.

“One thing that stood out to me despite being in IRAS for about five months is that I got the opportunity to draft a policy review paper. This is exciting as I would get to see through how the proposal would eventually lead to an amendment in policy,” she said.

“We have open postings to different divisions and rotation within divisions. IRAS also invests in growing its people by offering a wide variety of training opportunities such as in-house tax and data courses,” she explained. Data automation and analysis remains a tool of innovation for IRAS. Deanna shared about a centralised dashboard, among other digital projects, that helps the valuation team strategically monitor and prioritise risk assessments as well as allocate work across the teams based on complexity and status of review cases.

For sure, Deanna’s passion in her career is “real”.

Jordan Li

On Solid Ground

As much as we hate to admit it, Singaporeans are a rather practical bunch. When it comes to education, local students tend to gravitate towards sensible courses such as business and accountancy. However, degrees, no matter how prestigious they may be, must be accompanied by proper knowledge application.

In Jordan’s case, not only is he able to use what he learnt in school to a tee, but he is also fully aligned with his organisation’s values and ethos. With that, he constantly remains engaged and motivated at IRAS.

Said the IRAS Merit Undergraduate Scholar: “One of the things I felt strongly about was a desire to serve and contribute to society. Signing a scholarship with a statutory board such as IRAS was in line with this and would definitely allow me the opportunity to give back to society.”

What also convinced him to put his name on the dotted line was the vibe that he received while going through the scholarship application process.

“While I definitely found the interview sessions to be stressful, I also felt the culture of IRAS to be a very warm and friendly one, which only affirmed my decision to apply for the IRAS scholarship,” he said. “It was also a nice gesture on IRAS’ part to invite the senior scholars to talk to scholarship applicants, and I found the networking session very useful. Eventually, it was not a single defining factor that convinced me, but rather, my experience throughout the entire process.”

Currently, Jordan is on secondment to the Ministry of Finance (MOF), which he is very grateful for.

On his work, he explained: “My work in MOF involves tax strategy, and it is a really exciting and fast-paced role. The responsibilities are extremely varied. My responsibilities encompass: studies in tax analytics, staying abreast of various international tax developments that included two work trips to Paris, overseeing and coordinating the directorate-level workplan, and how they worked together to achieve a common goal.”

One of his most significant moments in his four-year career in IRAS involves the creation of a guide on the taxation of cryptocurrencies. As it was a relatively new entity, Jordan and his team had to move out of their comfort zones.

“Our team had to spend many hours understanding the mechanics of cryptocurrencies, and consulting with industry experts and private sector tax practitioners. It was a long and arduous process, but eventually our hard work and efforts bore fruit. The e-tax guide on the Income Tax Treatment of Digital Tokens is now on the IRAS website, you can read it for yourself!” he exclaimed.

Undoubtedly, Jordan has enjoyed a significant amount of success. Like Deanna, he was given many opportunities at IRAS, and with that, he is able to evolve into a well-rounded tax professional.

He gave some very practical advice to prospective scholars: “Be open to the variety of opportunities and tasks that are assigned to you, and always give your very best!”