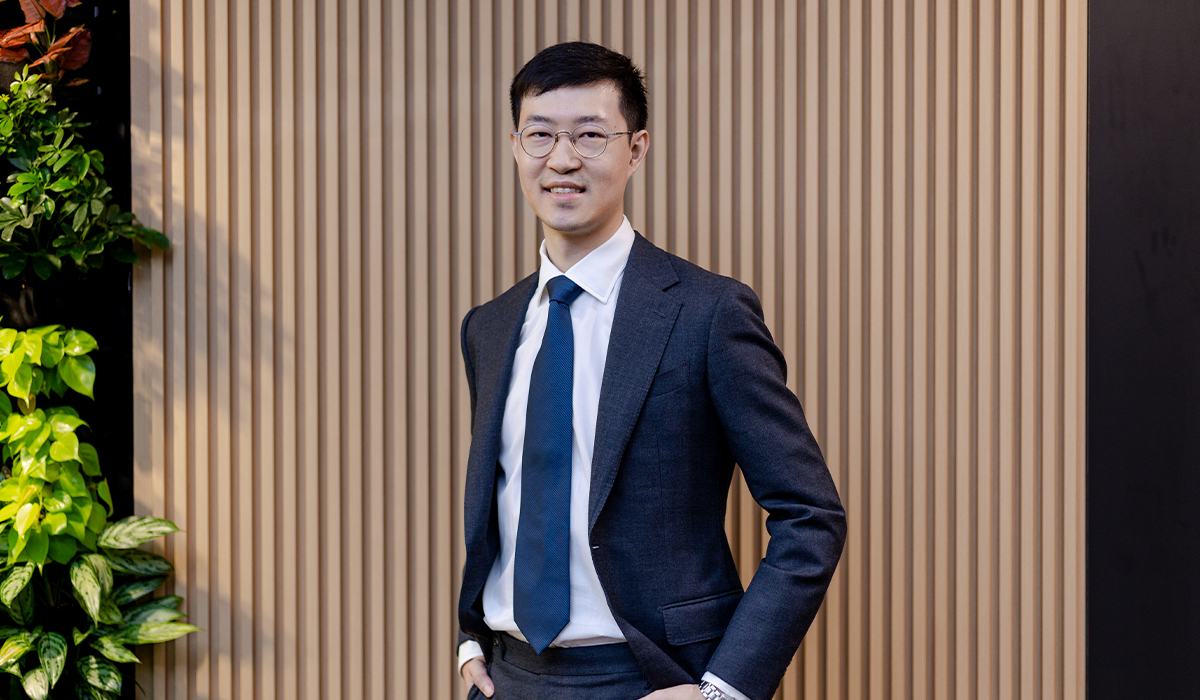

Andrew Ang is an Assistant Director in the Markets Policy and Infrastructure Department of the Monetary Authority of Singapore. Having received the MAS Undergraduate Scholarship, he went on to pursue a Bachelor of Science in Political Economy at King's College London. He has also graduated with a Master of Science in Finance and Economics from the London School of Economics and Political Science.

The Monetary Authority of Singapore (MAS) has long been the central bank, financial sector developer and financial regulatory authority of Singapore. It plays a pivotal role in maintaining Singapore’s financial resilience and fostering a conducive environment for sustainable growth. With its dual mandate of maintaining price stability and promoting sustainable economic growth, MAS formulates and implements monetary policies, supervises financial institutions, manages the official foreign reserves, and fosters a conducive environment for innovation and fintech advancements.

Solidifying Singapore’s position as a global financial hub, however, is a tall order and requires the aid of competent, qualified, and passionate individuals. MAS Undergraduate Scholarship recipient Andrew Ang is proud to be considered one of them. Today, he holds the position of Assistant Director in the Markets Policy and Infrastructure Department within the organisation. We spoke to Andrew to gain insights into the remarkable journey that led him to this pivotal role.

How did your interest in the financial sector come about?

As a student in junior college, I was fascinated by how the study of economics sought to explain how finite resources are allocated across various competing demands in an economy through market force. I also knew that I had barely scraped the surface of this subject during my studies, and I was keen to gain a more in-depth understanding of economics at the university level.

As a student of history reading about past global financial crises and the policies that brought the world into and out of such events, I was also increasingly cognisant of the consequential role of policy in shaping the economy, especially the financial sector.

Therefore, I wanted to pursue a career where there was an intersection between economics and policy and where I could play a part in the country’s financial sector development.

That’s fascinating! Was there any reason you chose to apply for a scholarship with MAS over other organisations?

MAS was a top option for me because of how important a role it plays in Singapore’s economy and financial sector – from the management of monetary policy to the development and regulation of the financial sector. My interest in the kind of work that MAS has to offer, coupled with my interest in economics and conviction in the important role of policy naturally led me to apply for the MAS Undergraduate Scholarship and pursue a career at MAS.

On the topic of your career with MAS, can you walk us through your journey with the organisation?

I started working at MAS in 2019, in the Markets Policy and Infrastructure Department. Having nurtured a keen interest in financial markets while at university, the Department was a good place to start my career journey at MAS and provided me with the opportunity to develop a deeper understanding of financial markets from the perspective of a financial regulator.

My first role was in the Markets and Infrastructure Supervision Division. There, I was exposed to the important supervisory work undertaken by MAS to support the smooth functioning of capital markets in Singapore.Specifically, I was part of the team that oversaw entities such as clearing houses and exchanges, ensuring that they were operationally resilient and that they managed their risks adequately.

Currently, as an Assistant Director in the Capital Markets Policy Division, I’m primarily focused on formulating policies that govern the way MAS regulates and supervises capital markets in Singapore and the entities that operate in the capital markets landscape. We do this with the objective of ensuring the integrity of our capital markets, investor protection and the mitigation of systemic risks. Given the dynamic nature of capital markets, an important part of the work in MAS is ensuring that our policies are calibrated to ensure that they are appropriate for the times.

The past four years have been eye-opening, and I’ve been able to deepen my understanding and expertise as a financial regulator – first, through the day-to-day yet crucial work of supervision, and now, through the strategic work of policy formulation and rules setting.

Andrew Ang

That sounds like crucial work. What do you personally find most meaningful about it?

The work I do directly impacts and influences the landscape of Singapore’s capital markets, or in the case of international policy work, on the global capital markets landscape. Knowing that I have a part to play in the ongoing evolution and development of our capital markets is very satisfying.

What avenues for professional growth and development are there at MAS?

There are opportunities to move laterally within the organisation and bosses are supportive of such moves as they value the experience that comes with being exposed to different functions in MAS.

MAS is a unique organisation with a range of functions. As such, officers have the opportunity to be at the forefront of our rapidly growing financial industry in different functions, such as by contributing to policies which promote economic growth and financial stability, initiatives to grow a trusted and innovative financial centre, or building tech and data solutions which can shape the future of financial services – particularly as the organisation is open to internal transfers to grow professional capabilities and develop a broad range of skills.

As a knowledge-intensive organisation, MAS also takes a broad approach to development, believing that officers’ personal growth benefits the entire organisation. There is a range of developmental opportunities at different phases of our careers at MAS, including mentoring and coaching, courses, and seminars to upgrade our knowledge and skills, rotations, and external attachments or overseas postings which broaden exposure and experience.

What advice do you have for individuals aspiring to pursue a career at MAS?

If a dynamic work environment and opportunities to develop depth in expertise are some of the things you are looking for, then I’ll encourage you to consider a career with MAS.

More generally, if you are keen to work at MAS, my advice is to not be afraid of working in areas that you may not be as familiar with or comfortable with. Instead, consider it as an opportunity to pick up new knowledge, learn more about your own strengths and weaknesses, and you may in fact also find yourself developing an interest in the area.