As Singapore’s central bank and integrated financial supervisor, the Monetary Authority of Singapore (MAS) plays a unique role in shaping the local economy through promoting sustained, non-inflationary economic growth. Through the formulation of strong policies and its supervision of all financial institutions in Singapore, MAS seeks to ensure that our financial industry remains vibrant, dynamic, and competitive, establishing the city as a regional and international financial centre. MAS is also in charge of managing Singapore’s exchange rate, foreign reserves, and liquidity in the banking sector. On top of these duties, MAS leads initiatives to educate retail investors.

Keeping the cogs running smoothly amidst the rapidly moving economic landscape takes a highly competent and dedicated team. Here, talent with diverse backgrounds and experiences converge to develop Singapore’s economic and financial landscape. Interdisciplinary teams come together, pooling their knowledge across different fields to carry out the MAS mission.

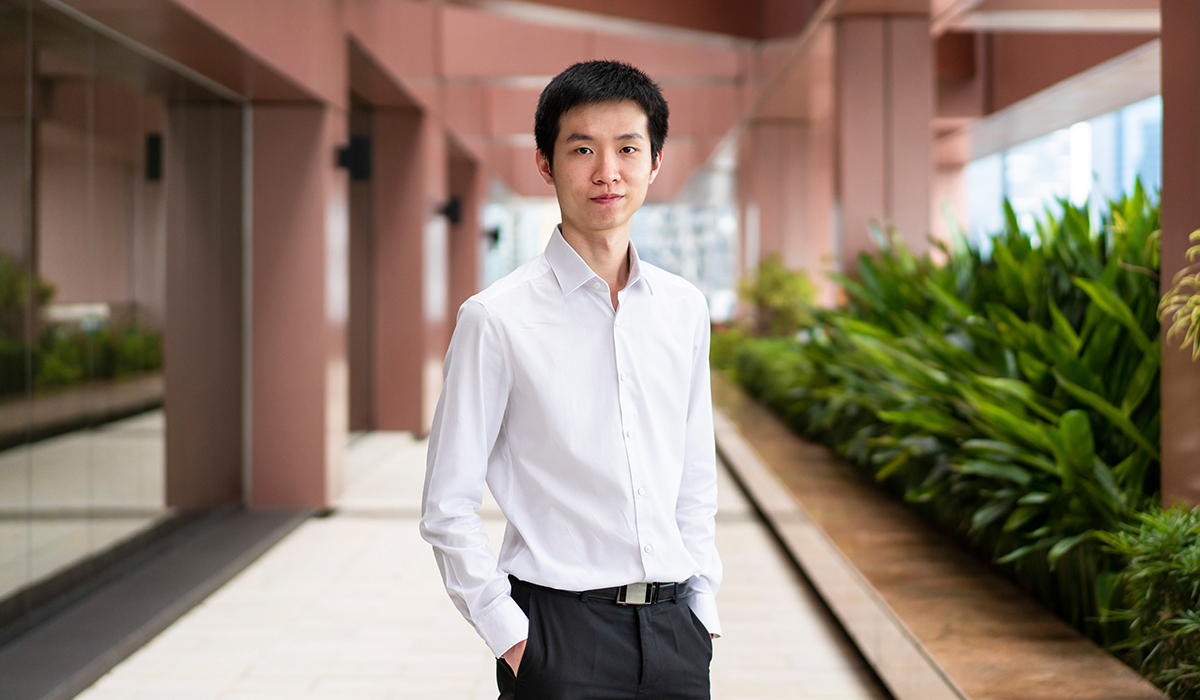

The MAS scholarship promises the opportunity to learn and grow at the world’s best universities before embarking on a rewarding career in a dynamic organisation. To find out more about the scholarship experience, BrightSparks spoke to 25-year-old Huang Yiheng, a MAS Undergraduate Scholar currently in the Prudential Policy Department.

Huang Yiheng

Associate

(Prudential Policy)

Master in Finance

– Princeton University

Bachelor of Arts

– Cornell University

My career in MAS so far involves developing prudential policies for banks. Working with my colleagues, I develop capital and liquidity standards for banks, and analyse the impact of international post-crisis regulatory reforms on banks. This involves implementing the Basel III standards in the local context, and drawing on data and literature to analyse whether these regulations have achieved their intended objective, and if there have been any unintended effects.

I’m driven by my interest in Economics, and I felt drawn to a career in the public service. I was also interested in the wide range of opportunities within MAS to learn about the various functions of a central bank and financial regulator. Given these reasons, I felt that a career in MAS would be a good fit for me and took up the MAS scholarship.

I most appreciate my overseas educational experience, which was truly enriching. As part of my liberal arts education, I was able to expose myself to a wide range of courses, such as computer science, history, and Southeast Asian politics. I even had the opportunity to take a central banking course under Alan Blinder, who once served as the Vice Chairman of the Federal Reserve Board. I was also fortunate to have built lasting relationships with friends from different backgrounds and cultures, who share the same drive and passion for learning.

As part of my scholarship journey, I interned with two different departments in MAS. I worked on the formulation of anti-money laundering policies under the Anti-Money Laundering Department, and studied trends in the global trade network under the Economic Policy Group. These internships helped me to gain a deeper understanding of the different roles and functions within MAS.

The best moments at work are experiencing the collegial atmosphere and supportive environment within MAS, where supervisors and colleagues are invested in my growth and development. As a junior officer, my supervisor provides guidance when necessary, while entrusting me with challenging projects that require original ideas and in-depth analyses.

It is also heartening to see that MAS is constantly exploring ways in which we can use technology to transform our work processes. For example, we are working on automating our data processes, from the collection to the analysis and visualisation of data. We are also exploring new ways to leverage the data, such as using machine learning techniques to identify potential market misconduct.

Career-wise, I hope to gain broader exposure to the other functions performed by MAS while developing new skills within the organisation, just like how my time in Prudential Policy Department has allowed me to experience the rigorous processes and considerations that underpin policy making in MAS.

Consider this scholarship if you enjoy contributing towards keeping Singapore relevant amidst a rapidly changing economic landscape. As the financial sector is constantly evolving, MAS needs officers with a diverse range of talents, and who are intellectually curious and willing to pick up new skills throughout their career. Most importantly, you should be passionate about public service, and have an interest in contributing towards Singapore’s economy.

My advice for aspiring scholars: Find out more about what a career within MAS entails. A scholarship decision is one you should take time to think about; figure out how it fits with your long-term interests and aspirations. Once you have chosen to take up the scholarship, it’s important to make the most out of the opportunities that the scholarship gives you.